Within the ever-changing financial markets, having the correct tools can make all the difference between success and uncertainty. MetaTrader 4 (MT4) is admired among the numerous trading platforms.

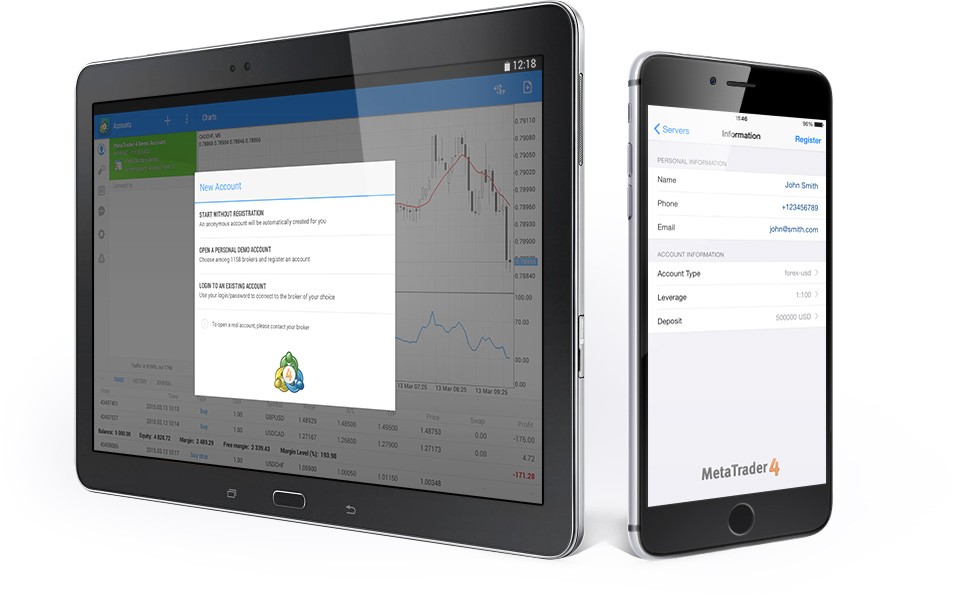

Known for its easy-to-use layout and robust analytic capabilities, MT4 stands as the preferred platform for worldwide traders. Its adaptability ranges from Forex to commodities and indices, presenting an all-around fix for novice and expert traders.

This piece talks about five strategies for mastering the MetaTrader 4 platforms. It uncovers the subtle tricks that can boost your trading experience to another level.

1. Understand the Dynamics of MetaTrader 4 Platforms

The first move in getting the hang of MetaTrader 4 is grasping how it works. The phrase “MT4 platforms” covers a broad array of tools that, when used effectively, can yield excellent outcomes.

MetaTrader 4, at its core, is loved due to its user-friendly interface. However, its real strength is in its various analysis tools and features strategically integrated to help traders in their quest to thrive financially.

The power of MetaTrader 4 lies in its robust charting capabilities. These satisfy traders’ needs by offering a wide variety of technical tools and chart styles. Whether you prefer the straightforward line charts or the more intricate Renko and Kagi charts, MT4 has it all for traders of every taste and tactic.

This tool lets users tailor their graphs extensively. It includes technical markers such as Moving Averages, Relative Strength Index (RSI), and Fibonacci pull-backs. People can stack many markers, leading to thorough technical evaluations for intelligent choices.

A unique quality that makes Platform mt4 stand out is its ability to use algorithmic trading through Expert Advisors (EAs). Traders can create and use EAs to make their strategies automatic, allowing trade execution based on set rules.

With automation, trading efficiency improves significantly. Plus, traders can execute strategies without the fluctuations of emotions common in manual trading.

2. Harness the Power of Technical Analysis

Once you understand the dynamics of the MT4 platform, the next step is to focus on employing technical analysis effectively. MetaTrader 4 includes a wide range of analysis tools. They help figure out market trends and when to start or end trades.

Stepping forward from general ideas of support and resistance, traders can study finer details of trendlines, Fibonacci retracements, and Bollinger Bands. Making use of many indicators together gives a broader view of market actions, helping traders make informed decisions.

However, it’s essential to find a middle ground – having too many signals could cause analysis paralysis, while a few might overlook things. Mastering technical analysis, mainly using MetaTrader 4, requires a skilled understanding of when and how to use these tools effectively.

3. Risk Management

Discussions about trading strategies are incomplete without highlighting the vital part of risk control. It’s a significant player in winning on MT4 platforms. MetaTrader 4 goes past the basics, providing a large set of tools and features that give traders detailed control. They can lessen risks, which is a crucial element for trading victory.

An integral part of managing risks on MetaTrader 4 is using exact stop-loss and take-profit points. Traders use these tools to set fixed exit points for trades, which help limit potential losses and take hold of profits. The platform’s user-friendly design lets traders tweak these points based on market shifts, allowing a flexible approach to the ever-evolving financial scene.

Position sizing is another vital element of effective risk management, handled by MetaTrader 4. Traders can adjust their position sizes based on their risk tolerance and the unique details of each trade. The platform’s sophisticated algorithms calculate the best positions. They consider things like account balance, risk percentage per trade, and how close the stop-loss level is.

With careful tweaking of the trades’ sizes, investors can create a fine harmony between potential gain and possible loss.

4. Diversification and Asset Allocation

Spreading out your investments and strategically placing your assets are key parts of a complete trading plan. MetaTrader 4 is a sophisticated tool that helps you put these ideas into action effectively.

Though popular for Forex trade, MetaTrader 4 shines in its adaptability. It can handle commodities, indices, and cryptocurrencies. This makes it a vital tool for traders. They can diversify their investments and take full advantage of different opportunities.

Furthermore, it’s essential to understand how different assets link up for effective asset division, and MetaTrader 4 offers the tools for analysis needed for this.

You can use the platform’s chart feature to check out how different assets have done in the past and see if they link. Try to include assets that don’t link or link poorly in your portfolios. This way, your portfolio remains robust and less susceptible to systemic risks.

5. Continuous Learning and Adaptation

Learning MetaTrader 4 is an ongoing process. You always need to learn and adapt. The market changes, and the strategies that worked great yesterday might not work as well tomorrow.

Moreover, being flexible and willing to adjust your strategies in line with market trends is crucial. MetaTrader 4 offers a live trading setting, helping you to test and enhance your approaches.

By nurturing a mindset of constant learning, folks in trading can stay on pace with the evolving markets. This strategy guarantees their survival and success when trading on the MetaTrader 4 platform.

Conclusion

Learning MetaTrader 4 isn’t just about using a system; it’s about discovering various tools and methods to aid your trading adventure. Comprehending the MT4 platform’s dynamics, using technical analysis to your advantage, managing risks wisely, and continuous learning are key steps to success.

Remember, becoming a pro needs practice, continuous learning, and adjusting to the always-shifting finance markets. With smart planning and disciplined executions, MetaTrader 4 could be the magic key to fully opening your trading potential.

Author Profile

Latest entries

BusinessApril 17, 2024Building Your Brand: 5 Strategic Paths To Stand Out In Market

BusinessApril 17, 2024Building Your Brand: 5 Strategic Paths To Stand Out In Market DecorApril 12, 20245 Creative Uses Of Custom Roller Blinds In Your Home

DecorApril 12, 20245 Creative Uses Of Custom Roller Blinds In Your Home BusinessApril 11, 2024Green Branding: 5 Ways Eco-Friendly Business Cards Elevate Your Sustainable Image

BusinessApril 11, 2024Green Branding: 5 Ways Eco-Friendly Business Cards Elevate Your Sustainable Image FinanceApril 10, 20245 Methods To Optimize Your Business Line Of Credit for Success

FinanceApril 10, 20245 Methods To Optimize Your Business Line Of Credit for Success