This has been necessary because in the current regulatory landscape it is important to understand who is actually in charge or benefiting a business. With the ever-evolution of financial crimes, organizations must look deeper than what is on the surface that is offered by legal organizations. That is where the principle of Ultimate Beneficial Owner (UBO) obtains its significance. The recognition and validation of ultimate beneficial owners can guarantee transparency, increase compliance requirements, and increase confidence in the business ecosystem. Firms that support Know Your Business (KYB) programs today consider the UBO identification as a core component of eliminating risk linked to money laundering, terrorist financing, tax evasion, and fraudulent jurisdictions.

What a UBO Is and Why It Is Important

The Act defines UBO or Ultimate Beneficial Owner as the natural person who actually owns or controls a legal entity but may not be represented in the formal corporate books. The concept aims at covering up ownership layers that the criminals tend to conceal in order to cover up illegal financial operations. UBO identification assists in establishing those who possess substantial interest in ownership, voting power or authority to make decisions in companies. In the absence of this understanding, organisations can be blindly recruiting shell companies, risky individuals and companies that are conducting illegal business.

Growing Importance of UBO Verification

UBO verification has established itself as a major element of KYB compliance regimes all over the world. The regulators have now made it mandatory that businesses undertake improved checks on the ownership information to make sure that the information is correct, genuine, and is current. UBO verification refers to the process whereby official documents, corporate registries and ownership structure are measured to validate the validity of individuals behind a business. This due diligence is important in uncovering red flags like layered ownership, nominee shareholders or offshore companies that are supposed to hide beneficial ownership.

In a world where financial crimes are carried out in international networks, effective UBO verification secures organisations with the penalty, a damaged reputation, and violations of regulations. It also gives an extra security aspect where all the parties in the supply chain are acting within the law.

The Role of UBO Identification in KYB

KYB compliance is a requirement that requires an organization to have knowledge about the legal status, structure and credibility of the businesses they are dealing with. Identification of UBO enhances KYB activities as it shows the real person behind a business. This assists institutions in determining risk more effectively and make effective decisions prior to venturing into partnerships, service delivery or sanctioning financial operations.

Proper UBO identification helps the compliance officers to assess the existence of any beneficial owners on the sanctions lists, watchlists, or adverse media lists. In case of discrepancies between stated ownership and found facts, then compliance teams can research more before taking action. UBO identification hence will be an area on which risk scoring and continuous monitoring processes are built.

The Role of UBO Checks in Preventing Financial Crime

UBO checks constitute the tools required in uncovering the suspicious pattern in corporate structures. These checks entail checking of ownership percentage, identifying the owners who are beneficial, and comparing the information with regulatory databases. By conducting UBO checks, organizations are in a position to detect instances where individuals deliberately conceal behind the duties of complicated corporate structure to escape accountability.

Regular UBO checks allow the businesses to identify and avoid schemes like tax evasion, corruption, embezzlement, and cross-border financial crimes. The checks facilitate a wider culture of transparency and contribute to the enforcement of ethical and regulatory standards by the business entering the global markets.

UBO Compliance and Global Regulatory Requirements

The enforceability of UBO is an international tendency that has become a common practice towards enhancing the anti-money laundering systems of jurisdictions. A lot of regulators also demand comprehensive disclosure of beneficial ownership arrangements and stipulate severe sanctions against incorrect or incomprehensive reporting. A company that does not comply with UBO is likely to be fined, cannot operate or can lose its license.

In order to fulfill the UBO requirements, the firms need to have the right ownership information on boarding, keep it updated and track the changes in ownership structure. The compliance teams are also required to maintain in-depth paperwork that confirms their verification process so that on an audit or regulatory review they are able to show due diligence.

UBO compliance is not a single undertaking. New information has to be taken quickly as the business expands or gets merged or ownership changes. Constant surveillance has become a compulsory norm and organisations will remain up to date with the changing regulatory demands.

BOI Reporting and UBO Transparency

Another important requirement that is linked to the UBO transparency is BOI Reporting or Beneficial Ownership Information Reporting. Most jurisdictions have also required companies to present beneficial ownership information to relevant financial regulators. This will see to it that regulators are provided with trusted information regarding ownership and this will enable them to identify suspicious behavior and impose compliance requirement in a more efficient manner.

BOI Reporting helps to contribute to the bigger mission to develop a transparent corporate environment. The fact that it does not allow people to mask themselves under the cloak of the anonymous business forms and assists the authorities to trace the links between two or more entities. In the case of the organization, proper BOI Reporting is a guarantee that the organization complies with KYB standards, minimizes risk, and establishes a reliable business ecosystem.

The Future of UBO Identification Compliance

With financial crimes becoming more and more sophisticated, the necessity to identify UBO will remain. The future of KYB compliance is in automated verification systems, real-time analytics, and multinational data-sharing systems. Companies, which invest in proper UBO identification and verification procedures, will be in a better place to handle risks and create a long-term trust.

UBO identification will also be an element of corporate transparency. It enables organizations to reveal the latent risks, meet the regulatory requirement and enable ethical business relationships. In a globalized world where financial transactions are becoming more and more interdependent, one has to know who is standing behind a business as an important way of keeping a business safe and within legitimate boundaries.

Author Profile

Latest entries

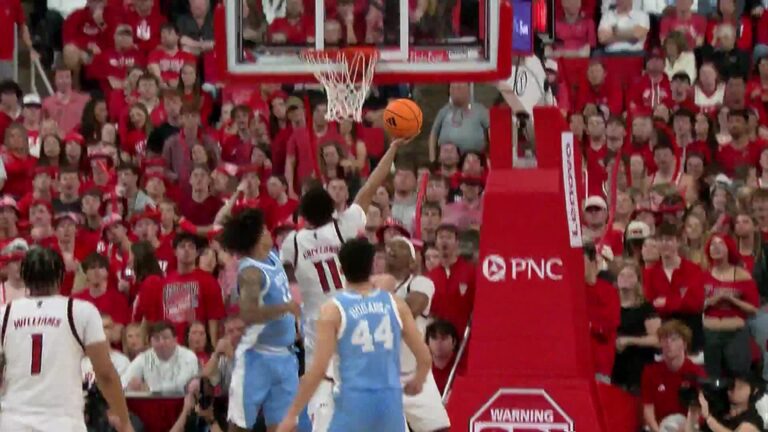

NCAABFebruary 18, 2026Tuesday Night Terror: The Underdogs Bark the Loudest in College Hoops

NCAABFebruary 18, 2026Tuesday Night Terror: The Underdogs Bark the Loudest in College Hoops The HubFebruary 18, 2026Your Ultimate Guide to Dune Buggy Rentals in the Desert

The HubFebruary 18, 2026Your Ultimate Guide to Dune Buggy Rentals in the Desert MLBFebruary 17, 2026Union in Turmoil: Tony Clark Resigns as MLBPA Chief Amid Federal Probe

MLBFebruary 17, 2026Union in Turmoil: Tony Clark Resigns as MLBPA Chief Amid Federal Probe HockeyFebruary 17, 2026Five-Star Dominance: Team USA Blanks Sweden to Reach Gold Medal Game

HockeyFebruary 17, 2026Five-Star Dominance: Team USA Blanks Sweden to Reach Gold Medal Game